2025-05-16: Singapore: Changi Airport Terminal 5 Breaks Ground, Marking Major Expansion

Malaysia and Russia Expand Strategic Cooperation in Trade, Technology, and Cultural Exchange

Good Morning,

Below are some of the most important developments in business and economics in Asia today.

▪️ Singapore: Changi Airport Terminal 5 Breaks Ground, Marking Major Expansion and Airline Realignment

Changi Airport’s Terminal 5 (T5) represents Singapore’s ambitious expansion to boost passenger capacity, connectivity, and sustainability in the eastern airport precinct.

▪️ Philippines: Mixed First-Quarter Earnings Highlight Sector Pressures and One-Off Impacts for Major Philippine Firms

Major Philippine companies reported mixed results in their first-quarter financial statements as sector-specific challenges and one-time items influenced earnings and revenues.

▪️ Malaysia: Malaysia and Russia Expand Strategic Cooperation in Trade, Technology, and Cultural Exchange

Malaysia and Russia are strengthening their bilateral cooperation in trade, technology, and cultural exchange.

▪️ Indonesia: Indonesia Advances Major Reforms in Outsourcing to Strengthen Labor Rights

Indonesia is moving to reform its outsourcing practices to strengthen labor rights and economic stability.

▪️ Japan: US-Japan Trade Negotiations Intensify Amid Tariff Uncertainty and Shifting Currency Policy

Japan and the United States are engaging in a series of negotiations over tariffs, trade regulations, and currency policy aimed at resolving barriers and strengthening economic ties.

▪️ Vietnam: Vietnam Advances Targeted Reforms to Accelerate Private Sector Growth

Vietnam is set to implement targeted mechanisms aimed at accelerating the growth of its private sector through new policies on land use, financing, tax incentives and administrative reform.

▪️ China: China and Mongolia Break Ground on New Cross-Border Railway to Boost Regional Trade

China and Mongolia are expanding their rail network and port capacities to strengthen cross-border trade and regional development.

▪️ China: China Unleashes Reserve Requirement Cuts and Monetary Easing to Bolster Economic Growth in 2025

China’s central bank has launched a suite of monetary easing measures in 2025 to boost liquidity and stabilize economic growth.

▪️ South Korea: Hyundai and Saudi Arabia Launch Construction of Kingdom’s First Automotive Production Plant

Saudi Arabia has commenced construction of its first domestic automotive production plant through a partnership between Hyundai Motor Company and the Public Investment Fund.

For more information on these developments, please see the full report below.

Thanks for reading,

Rodney J Johnson

Today's Developments

Widely Reported On Issues of Importance

-

Changi Airport Terminal 5 Breaks Ground, Marking Major Expansion and Airline Realignment

Changi Airport’s Terminal 5 (T5) represents Singapore’s ambitious expansion to boost passenger capacity, connectivity, and sustainability in the eastern airport precinct.

Changi Airport officially launched T5 with a groundbreaking ceremony on May 14, 2025, led by Prime Minister Lawrence Wong.

The terminal’s first phase is scheduled to open in the mid-2030s and will raise the airport’s annual passenger capacity by 50 million—from 90 million to 140 million. Covering an area larger than Toa Payoh, T5 consists of three interconnected sections—T5A, T5B and T5C—linked by automated people movers.

Beyond capacity growth, the broader Changi East development, which includes T5, carries an investment running into the tens of billions of dollars.

Authorities expect to generate thousands of jobs across construction, operations and ancillary services, while local businesses will supply goods and services throughout the multi-year build. The project aims to transform the eastern precinct into a vibrant business and lifestyle hub.

T5’s structural design incorporates resilience against extreme weather and scalable technology solutions.

Automated systems will handle baggage sorting and passenger flow management, and smart building controls and clean-energy integration will support sustainability goals. Advanced digital technologies will optimize operational efficiency and enable real-time monitoring of terminal systems.

The development also enhances connectivity with new road links and integration into the existing public transportation network.

An underground link will connect T5 to Terminal 2 for faster transfers, and planned air-sea transfer facilities will bolster intermodal links. A dedicated ground transportation center will bring together bus, rail, taxi and private-hire services, while the Thomson–East Coast Line extension will provide direct rail access between T5 and Singapore’s city center.

Upon opening, Singapore Airlines and its subsidiary Scoot will consolidate operations into T5, moving from Terminals 1, 2 and 3.

This realignment will create operational synergies, free up capacity in the existing terminals and accommodate future network growth. The Singapore Airlines Group currently serves around 170 city links and plans to expand to more than 200 by the mid-2030s.

T5’s footprint will equal that of all existing terminals combined, reinforcing Singapore’s ambition to strengthen its role as a global aviation hub.

The Changi East development also includes an industrial zone dedicated to air cargo operations, enhancing Singapore’s logistics hub status in the region. Adjacent urban districts will offer commercial, retail and lifestyle spaces for airport users and local residents, while new roles in data science, smart-facility management and sustainability will emerge.

Originally announced in 2013, the T5 project paused for two years during the COVID-19 pandemic, allowing for design refinements in response to evolving aviation and passenger requirements.

Since then, Changi Airport has grown to four terminals and maintained its global reputation, including earning a 13th Skytrax World’s Best Airport award. The aviation ecosystem centered on Changi contributes roughly 5 percent of Singapore’s GDP and supports extensive job creation in tourism, aerospace and logistics.

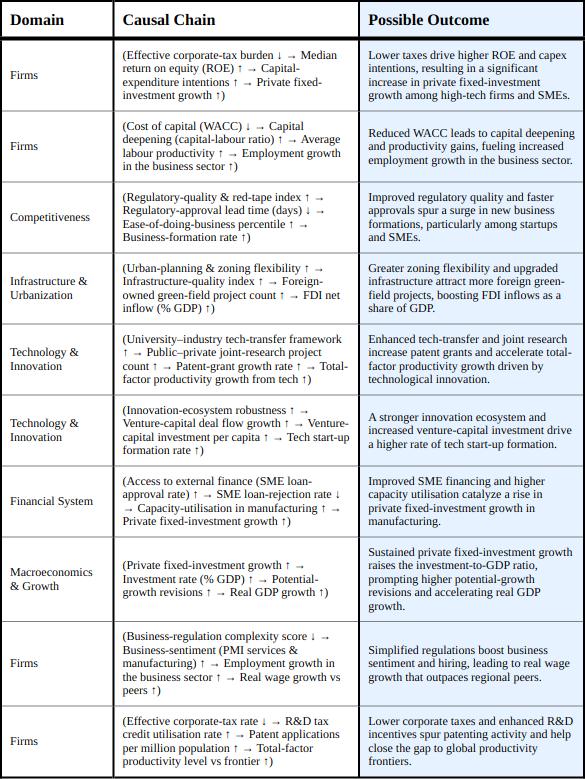

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The Massive Capacity Surge shock—expanding Changi’s annual throughput from 90 million to 140 million passengers and matching the footprint of all existing terminals—will sharply reduce the airport’s capacity gap, raise the infrastructure-quality index, amplify urban productivity premiums, and support higher GDP per capita growth and faster convergence with advanced economies.

The Tens of Billions in Investment and Job Creation shock—anchored by a multi-decade, tens-of-billions-dollar Changi East development—will drive up national infrastructure-investment levels, boost the infrastructure-quality index, diffuse greater business confidence and, in turn, sustain higher FDI net inflows as a share of GDP.

The Consolidation of Singapore Airlines Operations shock—relocating SIA and Scoot into T5 and freeing capacity in Terminals 1–3—will enable more liberal aviation service agreements, increase air-cargo capacity utilization, dampen freight-rate volatility and help domestic exporters capture larger shares of global markets.

The Integration of Advanced Automation and Resilient Design shock—embedding automated baggage handling, smart passenger-flow management, real-time digital monitoring and clean-energy systems—will accelerate the national digital-technology adoption rate, lift SME digital-tool uptake, improve customs and infrastructure performance, and push Singapore’s ease-of-doing-business ranking higher.

The Enhanced Multi-Modal Connectivity shock—delivering new road links, an underground connector to T2, air-sea transfer facilities, a ground transport center and the Thomson–East Coast Line extension—will raise the multimodal-connectivity index, slash customs clearance and door-to-door export lead times, and strengthen the overall logistics-performance index.

The Emergence of Smart-Facility and Sustainability Roles shock—spurred by T5’s high-tech operations—will generate demand for data-science, digital-maintenance and sustainability professionals, catalyzing growth in advanced-services clusters and reinforcing Singapore’s position as an innovation hub.

References for this Development

PM Lawrence Wong at the Changi Airport Terminal 5 Groundbreaking Ceremony

PM's Office - E | English | Government

SIA and Scoot flights to operate out of Changi Airport Terminal 5 when it opens

Channel News Asia | English | News

Channel News Asia | English | News

樟宜机场T5投入运作后 新航和酷航将在新大厦运营

8World News | Local Language | News

-

Mixed First-Quarter Earnings Highlight Sector Pressures and One-Off Impacts for Major Philippine Firms

Major Philippine companies reported mixed results in their first-quarter financial statements as sector-specific challenges and one-time items influenced earnings and revenues.

JG Summit Holdings Inc. posted a 61 percent drop in first-quarter earnings to P4.3 billion after its petrochemicals unit recorded a P3.3 billion loss and last year’s nonrecurring gains did not recur. Excluding those one-off items, core net income fell 7 percent to P7.4 billion, while revenue rose 1.7 percent to P98.2 billion on sustained demand in travel, mall, and hotel operations.

In contrast, Universal Robina Corp posted a 2 percent decline in net income to P4.1 billion, while core profit, excluding reduced foreign exchange gains, increased 5 percent.

Real estate developer Robinsons Land Corp maintained first-quarter earnings at P3.5 billion and generated revenues of P10.7 billion, reflecting stability in its investment portfolio.

Aviation players faced a sharper downturn: Cebu Air Inc. saw profit plunge 79 percent to P466 million due to expansion-related costs.

By contrast, San Miguel Corp nearly quadrupled first-quarter earnings to P43.4 billion thanks to one-time gains from a partial divestment of power assets.

Stripping out those nonrecurring items, core net income climbed 31 percent to P19 billion, driven by stronger contributions across its main businesses. Total revenue, however, fell 8 percent to P360.9 billion as lower crude prices weighed on its fuel segment and the deconsolidation of the 1,200-MW Ilijan power plant took effect.

Within San Miguel’s portfolio, its Food and Beverage arm delivered a 16 percent rise in net income to P11.6 billion on robust poultry and processed-meat sales, lifting revenues to P46.3 billion.

San Miguel Global Power recorded a 4 percent decline in revenues to P42.5 billion following Ilijan’s exit from consolidation, partially offset by gains at other plants. Petron Corp managed a 2 percent profit increase to P4 billion despite a 14.6 percent drop in revenues to P227.6 billion driven by weaker exports.

Meanwhile, MacroAsia Corp boosted net income 21 percent year-on-year to P313.9 million as in-flight and catering revenues grew 9 percent to P1.15 billion and ground-handling and aviation services climbed 2 percent.

Total revenue rose 6 percent to P2.35 billion, and the company served 6.25 million in-flight meals, up 13 percent.

Telecom operator Converge ICT Solutions Inc. delivered an 18 percent increase in first-quarter net income to P3.02 billion on 13 percent revenue growth to P10.8 billion.

Residential segment revenues climbed 12 percent to P9.12 billion, while enterprise revenues jumped 23 percent to P1.69 billion. Fiber-port utilization reached 34.4 percent, with 5.4 million ports available for future deployment.

Consumer goods manufacturer Monde Nissin Corp saw first-quarter profit fall 21.5 percent to P2.74 billion amid challenges in its meat-alternative business, while overall revenue rose 2.8 percent to P20.9 billion.

Its Asia-Pacific branded food and beverage segment posted a 4.1 percent increase in net sales to P17.6 billion. Quorn Foods narrowed its net loss to P58 million as gross profit grew 10.8 percent to P759 million and gross margin improved to 23 percent. Monde Nissin plans to invest P7.5 billion in 2025, including P6.6 billion for its Asia-Pacific food unit, to build a new biscuit plant and expand capacity for key brands.

References for this Development

SMC Q1 profit surges by nearly four-fold on gains from asset sale

Inquirer Net | English | News

Converge posts 18% profit growth in Q1, led by residential, enterprise segments

Inquirer Net | English | News

Monde Nissin profit down 21.5%, dragged by meat alternative business

Inquirer Net | English | News

JG Summit Q1 profit plunges by 61% on petrochem losses

Inquirer Net | English | News

MacroAsia profit surges 21% to P313.9 million

Inquirer Net | English | News

-

Malaysia and Russia Expand Strategic Cooperation in Trade, Technology, and Cultural Exchange

Malaysia and Russia are strengthening their bilateral cooperation in trade, technology, and cultural exchange.

During Malaysian Prime Minister Datuk Seri Anwar Ibrahim’s visit to Moscow from May 13 to May 16, both governments reaffirmed their commitment to deepening trade and investment ties. The two leaders emphasized the strategic importance of cooperation and identified opportunities for growth in aerospace, science, technology and innovation, and Technical and Vocational Education and Training (TVET). Prime Minister Anwar noted Russia’s support for Malaysia’s development in these key sectors.

A focal point of their discussions was collaboration in digitalisation, artificial intelligence (AI), and the semiconductor industry.

Prime Minister Anwar stressed the crucial role these industries will play in Malaysia’s future economic growth and outlined Malaysia’s desire to leverage Russian expertise and investment. President Vladimir Putin confirmed Russia’s dedication to backing Malaysia in high-tech domains, reflecting a shared drive to foster innovation-led development.

In 2024, Russia ranked as Malaysia’s ninth-largest partner among European countries, with bilateral trade reaching RM11.46 billion (US$2.48 billion).

Malaysian exports to Russia consist mainly of electrical and electronic products, machinery, and processed foods, while Malaysia imports petroleum products, minerals, and chemical products. Both sides expressed interest in expanding and diversifying trade, aiming to include more value-added goods and establish joint ventures in manufacturing and research and development.

Prime Minister Anwar also met with the Grand Mufti of Russia, Sheikh Ravil Gaynutdin, highlighting the role of religious and cultural ties in economic cooperation.

They discussed strengthening Islamic institutions, sharing expertise, and developing Russia’s halal industry, with Malaysia positioned as a global model for halal certification. Anwar’s presentation of a Russian-language Quran supports Malaysia’s initiative to distribute one million Qurans worldwide, and Sheikh Ravil’s gift of a historic Uthmani Quran from Uzbekistan symbolizes enduring cultural exchanges that could advance halal markets and related educational partnerships.

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The “Strategic High-Tech Partnership in Digitalisation, AI, and Semiconductors” shock could lead Malaysia to ramp up government procurement of AI and semiconductor solutions, triggering more public–private R&D partnerships, expanding domestic AI compute capacity, accelerating AI adoption that lifts GDP via total-factor productivity growth, attracting larger technology FDI inflows, loosening dual-use export controls to further boost startup formation, and strengthening IP protections to secure high-tech export market share.

The “Joint Aerospace, Science, and TVET Initiatives” shock could expand Malaysia’s STEM talent pipeline and workforce digital literacy through enhanced vocational and higher-education collaborations, fueling a higher tech-startup formation rate, drawing greater venture-capital deal flow, driving up private fixed-investment growth, and reinforcing university–industry tech transfer frameworks that elevate patent filings and citation impact.

The “Religious-Cultural Dimension to Economic Ties via the Halal Industry” shock could deepen cultural and religious pluralism protections by embedding halal-industry cooperation and Quran exchanges into bilateral ties, which would raise cultural-representation parity, improve civic-trust composite scores, and strengthen Malaysia’s social-capital index—thereby creating a more resilient societal foundation for sustained economic collaboration.

The “Shift Toward Value-Added Trade and R&D Collaboration” shock could increase trade openness and preferential market access for higher-value goods, temporarily narrowing export-basket diversification but ultimately driving up Malaysia’s real export market share and business-sector employment; it will also spur venture-capital availability that boosts deal flow, private fixed-investment growth, and real GDP growth, while high-skill immigration openness fuels brain circulation, raises patent intensity, and attracts further private investment in technology sectors.

References for this Development

PM Anwar attends roundtable meeting with Russian industry leaders

Borneo Post | English | News

Malaysia-Russia signal stronger ties with focus on trade, science and culture

Borneo Post | English | News

Russia sees prospects for joint venture with Malaysia in O&G, nuclear energy

Borneo Post | English | News

Anwar, Putin suarakan hasrat bersama perkukuh perdagangan, pelaburan

Anwar, Putin voice joint desire to strengthen trade, investment

Sinar Harian | Local Language | News

Anwar perkukuh hubungan dengan komuniti Islam Russia

Anwar strengthens ties with Russian Muslim community

Kosmo | Local Language | News

Anwar invites Russian airlines including Aeroflot to resume direct flights to Malaysia

Borneo Post | English | News

Russia a great friend of Malaysia, says Anwar

Borneo Post | English | News

பக்குவப்பட்ட மலேசியா பிரதமர் அன்வாரின் ரஷ்ய பயணத்தின் முக்கியத்துவம்

Significance of Malaysian Prime Minister Anwar's visit to Russia

Vanakkam Malaysia | Local Language | News

Watch As Anwar Makes Putin Laugh With His Second Wife Remark At The Kremlin

SAYS | English | News

-

Indonesia Advances Major Reforms in Outsourcing to Strengthen Labor Rights

Indonesia is moving to reform its outsourcing practices to strengthen labor rights and economic stability.

Outsourcing Regulation, Elimination, and Labor Rights

President Prabowo Subianto has called for phasing out outsourcing in Indonesian companies and asked the National Workers Welfare Council to chart a careful transition that preserves investment appeal.

During a May Day event, he emphasized that any shift away from outsourcing must protect investor confidence and worker welfare. In response, Minister of Manpower Yassierli is drafting a Ministerial Regulation that reflects the President’s vision and addresses workers’ concerns by defining clear roles, responsibilities, and compliance requirements for all parties.

Esther Sri Astuti, Executive Director of the Institute for Development of Economics and Finance (Indef), argues that converting outsourced workers into permanent employees will extend job security and welfare benefits.

Under this approach, companies would adhere more rigorously to wage standards and health insurance provisions, potentially raising living standards for a large segment of the workforce while ensuring full compliance with employment regulations.

The Indonesian Employers Association (Apindo) cautions that eliminating outsourcing could increase labor costs, forcing companies to raise prices for goods and services.

In a statement, Apindo’s Head of Manpower Bob Azam recommends strengthening the existing outsourcing framework rather than abolishing it outright. He warns that abrupt changes may push workers into informal jobs that lack wage protections and social benefits, posing risks to broader economic stability.

Recent legal developments support this reform agenda.

Constitutional Court Decision Number 168/2023 and Law Number 6 of 2023 on Job Creation now require outsourcing firms to operate as legal entities with proper permits, mandate improved wage provisions, and insist on written agreements for third-party work delegation. The law also calls for clearly defined scopes of work to balance operational efficiency with worker protections.

Labor observer Timboel Siregar, BPJS Watch Advocacy Coordinator, urges the government to intensify supervision of outsourcing activities and shut down unlicensed or fake outsourcing firms that fail to meet professional or union standards.

He stresses that robust enforcement mechanisms are essential to safeguard work protection and social security access. Economist Wijayanto Samirin of Paramadina University recommends improving outsourced workers’ conditions by guaranteeing reliable BPJS Kesehatan coverage, establishing transparent contracts that outline rights and obligations, and setting adequate income standards to ensure a baseline quality of life.

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The phase-out of outsourcing arrangements—driven by President Prabowo’s May Day directive and the forthcoming Ministerial Regulation—constitutes a shock that reduces firms’ labour-flexibility index, raises unit labour costs, and passes higher costs onto consumers, thereby pushing up headline and core inflation and amplifying month-to-month inflation volatility; it also stabilizes job tenure, lowers under-employment, reduces income volatility, and strengthens the sense-of-fairness index, which in turn should dampen protest frequency and escalation severity.

The mandatory requirement that outsourcing firms register as legal entities with proper permits, formalize written third-party work agreements, and clearly define scopes of work—as codified in Constitutional Court Decision 168/2023 and Law No. 6/2023—raises the business-regulation complexity score, prolongs regulatory-approval lead times, and erodes perceived regulatory quality; these causal effects deter foreign direct investment, weaken business-confidence diffusion indexes, and ultimately depress both FDI net inflows and domestic investment rates as a share of GDP.

The potential rise in labor costs and resultant price inflation highlighted by the Indonesian Employers Association signals a shock that may drive up firms’ unit labour costs, force higher consumer prices, erode consumer-confidence indexes, and lessen household consumption’s contribution to GDP; if companies react by trimming formal hiring, displaced workers risk moving into informal jobs lacking wage and social protections, undermining broader economic stability and social-safety-net generosity.

The intensified crackdown on unlicensed and fraudulent outsourcing firms—advocated by labor observers and BPJS Watch—strengthens enforcement mechanisms, shrinks the social-security coverage gap through universal BPJS Kesehatan enrollment, lowers out-of-pocket medical expenditure shares and catastrophic-expense incidence, and cuts medical-bankruptcy filings; these improvements reduce health-adjusted labour-productivity losses and bolster post-tax, post-transfer income equality (Gini coefficient), further elevating public perceptions of fairness.

References for this Development

Ekonom sebut penghapusan outsourcing beri kepastian untuk pegawai

Economist says elimination of outsourcing provides certainty for employees

Antara News | Local Language | News

BPJS Watch sarankan penguatan pengawasan dan regulasi "outsourcing"

BPJS Watch recommends strengthening supervision and regulation of "outsourcing"

Antara News | Local Language | News

Jaminan bagi pekerja jadi perbaikan utama dalam sistem outsourcing

Guarantees for workers are the main improvement in the outsourcing system

Antara News | Local Language | News

-

US-Japan Trade Negotiations Intensify Amid Tariff Uncertainty and Shifting Currency Policy

Japan and the United States are engaging in a series of negotiations over tariffs, trade regulations, and currency policy aimed at resolving barriers and strengthening economic ties.

Japanese and US officials will hold working-level talks in Washington next week to address US tariff measures and lay the groundwork for ministerial negotiations in early May. In earlier exchanges, Japan offered to review regulations to facilitate American vehicle imports and to increase its purchases of corn and soybeans, while the United States raised concerns about Japanese nontariff barriers. Economic Revitalization Minister Akazawa Ryosei has called for a strategic approach that balances each country’s interests with its domestic circumstances. To advance these discussions, Vice Foreign Minister Funakoshi Takehiro will meet Deputy Secretary of State Christopher Landau in Washington to set a clear timeline for third ministerial talks, likely in mid-May or later.

On May 14, 2025, President Trump announced that his administration will remove currency policy from tariff negotiations after the US dollar weakened amid skepticism over large-scale tariffs.

This decision reverses earlier plans to devalue the dollar to boost US manufacturing exports and confines discussions with trading partners to banning unfair currency manipulation—a principle already endorsed by major nations. Going forward, Treasury Secretary Bessent will handle exchange rate issues and maintain a strong dollar policy, even as markets show concern over recent sell-offs in US Treasury bonds, dollars, and equities. The dollar’s slide from roughly ¥155 at the start of the Trump administration to about ¥146 recently reflects market jitters over tariffs, and currency issues did not arise in the US agreements with the U.K. and China.

Japanese automakers are feeling growing pressure from the current US trade environment.

Nissan Motor Co. plans to close plants and cut 20,000 jobs globally, citing high capital requirements for next-generation electric vehicles and uncertainty over US tariff policies. A proposed merger with Honda Motor Co. has been abandoned, though Honda continues to pursue strategic partnerships and component standardization in the electric-vehicle sector. Honda projects a net profit of ¥250 billion for the fiscal year ending March 2026—a sharp decline driven by an estimated ¥650 billion hit from US tariffs—and its China sales fell 30 percent in 2024, including a 40.8 percent drop in April, prompting S&P Global Ratings to revise its outlook to negative from stable. Mazda Motor Corp has suspended its earnings forecast amid tariff uncertainties, estimating a ¥910 billion impact in April alone while offsetting US declines through cost cuts and stable global volumes. Mitsubishi Motors anticipates a ¥40 billion reduction in operating profit and is exploring joint SUV production with Nissan, as well as partnering with Taiwan’s Foxconn to supply electric vehicles in Australia.

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The removal of currency policy from tariff negotiations on May 14, 2025, could increase exchange-rate volatility, feeding through into greater inflation volatility and elevating the 12-month-ahead recession probability as monetary-policy calibration becomes more challenging.

The US dollar’s slide from roughly ¥155 to ¥146 amid tariff skepticism may drive up import-price pass-through, raise headline CPI and erode real household purchasing power, thereby weakening consumer-confidence indices.

Nissan’s plan to close plants and cut 20,000 jobs globally in response to tariff uncertainty and high EV capital requirements is likely to shrink market-size and demand potential, dent business confidence and slow private fixed-investment growth.

Honda’s projected ¥650 billion profit hit from US tariffs and subsequent S&P outlook downgrade will likely push down its return-on-invested capital, widen corporate credit spreads and dampen its—and potentially its peers’—capital-expenditure intentions.

Mazda’s suspension of its earnings forecast amid tariff uncertainty may raise its weighted-average cost of capital, lengthen its working-capital cycle and depress its cash-to-short-term-debt ratio, heightening liquidity and refinancing risks.

By sidelining currency policy in high-level talks, the US risks a decline in trade openness and preferential market access, which could worsen the World Bank’s Logistics-Performance Index rankings and discourage new foreign-owned green-field investments.

Excluding currency issues from comprehensive negotiations may introduce greater uncertainty into firm supply chains, slow supplier delivery times and boost inventory days on hand, straining corporate working capital.

The combined effects of tariff uncertainty and a weaker dollar threaten to narrow the export basket—raising the Herfindahl-Hirschman concentration index—and erode US real export market share in key industries.

References for this Development

NY外為:ドル売り一服、赤沢担当は来週訪米で調整との報、米、日本や韓国との通商協定合意近いとの報道

Yahoo Finance | Local Language | News

Japan, US to likely hold working-level talks next week on Trump's tariffs

NHK | English | News

赤沢氏 関税巡り来週の訪米を調整

Akazawa to visit US next week over tariffs

Yahoo News Japan | Local Language | News

Japanese automakers looking at a ¥1 trillion hit from Trump tariffs

Japan Times | English | News

米国産日本車を逆輸入 日本政府案

Japanese government proposal to reimport US-made Japanese cars

Yahoo News Japan | Local Language | News

Third round of U.S.-Japan tariff talks may be held next week: report

Japan Times | English | News

【速報】政府関係者、3回目の通商協議のため、赤沢経済再生担当大臣が来週後半の訪米を調整

Yahoo Finance | Local Language | News

欧米為替:デイリー見通し ドル・円/日米財務相会談にらみ

Yahoo Finance | Local Language | News

トランプ関税、米ビッグスリーに逆風 ホンダ社長「北米、かなり戦える」HVで強み

The Sankei News | Local Language | News

トランプ政権、関税交渉に通貨政策含めない方針 ドル安加速で転換

Mainichi Shimbun | Local Language | News

Trump tariffs may accelerate restructuring of already struggling Japan auto industry

The Mainichi | English | News

Japan under pressure from U.S. to invest in Alaska LNG pipeline

Japan Times | English | News

米、関税交渉の一環でドル安模索せず=報道

U.S. not seeking weaker dollar as part of tariff talks: report

Yahoo Finance | Local Language | News

-

Vietnam Advances Targeted Reforms to Accelerate Private Sector Growth

Vietnam is set to implement targeted mechanisms aimed at accelerating the growth of its private sector through new policies on land use, financing, tax incentives and administrative reform.

On May 14, the National Assembly Standing Committee reviewed a draft resolution to implement Politburo Resolution 68-NQ/TW, with Deputy Minister of Finance Nguyn c Tm proposing measures that depart from existing laws to strengthen high-tech firms, SMEs and innovative startups.

The draft seeks to institutionalize actions that immediately boost private sector confidence, mobilize resources for socio-economic infrastructure and drive double-digit growth.

The proposal mandates at least a 30 percent reduction in land rent for high-tech and SME tenants in industrial parks during their first five years, with the state refunding these costs directly to investors.

It requires Provincial People’s Committees to allocate a minimum of 20 hectares in each industrial park for high-tech and innovation-driven startups, and it allows private enterprises to lease unused public land and properties—including facilities within government agencies—to expand operations.

Financial incentives include access to loans at a fixed 2 percent annual interest rate for projects that meet environmental, social and governance standards.

Innovative startups will enjoy a two-year corporate income tax exemption followed by a 50 percent reduction for the subsequent four years, while experts and organizations engaged in research, development and creative startup activities receive personal income tax exemptions. The draft also designates local budget lines to fund infrastructure development in industrial parks and clusters.

To streamline administrative procedures, the resolution shifts from pre-inspection to post-inspection, limits routine checks to once per year under normal circumstances and exempts compliant enterprises from physical inspections.

It prescribes civil and administrative sanctions for most violations, reserves criminal prosecution for serious infractions and imposes strict penalties on officials who abuse inspection authority or impose unnecessary burdens on businesses.

Resolution 68-NQ/TW classifies tasks into three groups—urgent measures for immediate institutionalization, amendments to existing laws and longer-term initiatives requiring research—and the draft focuses on the first group, covering five policy areas: improving the business environment; enhancing access to land and finance; promoting innovation and digital transformation; strengthening workforce training; and facilitating integration into global value chains.

National Assembly Chairman Trn Thanh Mn said the committee expects to pass the resolution on May 17 after final edits to ensure consistency with existing laws and international treaties.

Deputy Prime Minister Nguyn Ch Dng and other members called for clear definitions of industrial park criteria and transparent funding mechanisms to prevent policy manipulation. The resolution sets a target of 2 million private enterprises by 2030 and introduces revised tax structures effective June 1, 2026.

Vice Chairman V Hng Thanh praised the collaboration between the National Assembly’s committees and the Ministry of Finance in preparing the draft.

The Standing Committee approved the resolution for submission to the full National Assembly and committed to incorporating feedback from the May 14 session before distributing the final text to deputies.

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The Major Land Rent Reductions shock will cut industrial-park land rents by at least 30 percent for high-tech firms and SMEs in their first five years, directly boosting after-tax returns and median ROE; this cost relief is likely to drive up capital-expenditure intentions, fuel private fixed-investment growth and accelerate employment and productivity gains in targeted sectors.

The Deep Corporate and Personal Tax Cuts shock will grant innovative startups a two-year corporate income tax holiday plus a 50 percent reduction thereafter, and exempt R&D personnel from personal income tax; the resulting decline in effective tax burdens should raise firms’ willingness to invest in R&D, increase patent applications per capita, improve total-factor productivity and help close Vietnam’s gap to global productivity frontiers.

The Ultra-Low Interest Financing shock will offer ESG-compliant projects loans at a fixed 2 percent rate, slashing WACC for eligible enterprises; lower financing costs are expected to spur capital deepening—raising the capital-labour ratio—boosting average labour productivity, expanding capacity utilisation in manufacturing and driving further private fixed-investment growth.

The Streamlined Administrative Oversight shock will shift inspections from pre-approval to post-compliance, limit routine checks to once per year and penalize officials who abuse their authority; reduced red tape and faster regulatory approvals should lift Vietnam’s ease-of-doing-business ranking, trigger a surge in business formations, improve business sentiment (PMI), fuel hiring and propel real wage growth above regional peers.

The Dedicated Land Allocation for Innovation shock will require provinces to set aside at least 20 hectares in each industrial park for high-tech and innovation-driven startups, and open public land leasing to private firms; enhanced zoning flexibility and infrastructure funding are set to attract more foreign green-field projects, raise FDI net inflows as a share of GDP, and strengthen Vietnam’s integration into global value chains.

WHERE WE GO FROM HERE (Three Possible Outcomes)

LOW PROBABILITY: 15%

Reforms Derailed by Political Pushback and Market Shocks

Firms struggle to leverage land‐rent cuts and tax breaks as unclear guidelines and provincial resistance delay project approvals. If Provincial People’s Committees defer industrial‐park allocations or inject ambiguous criteria, take‐up of incentives stays below 20 percent of targeted SMEs and high‐tech firms.

Competitiveness gains stall as administrative reforms are hollowed out by officials reverting to pre‐inspection regimes. Should central authorities fail to enforce penalties on abusing inspectors, ease-of-doing-business rankings slip and new business formations grow at less than 5 percent annually.

Financial System impact is muted when banks shy away from 2 percent ESG‐linked loans, citing weak enforcement of environmental and social governance standards. A spike in nonperforming SME loans above 5 percent would signal that low financing costs are not reaching the intended firms.

Infrastructure & Urbanization improvements falter if local budgets divert infrastructure lines away from industrial parks. FDI projects bypass underfunded zones, leaving industrial‐park occupancy below 50 percent and FDI inflows stuck near 4 percent of GDP.

Macroeconomics & Growth remain tepid, with private fixed‐investment growth under 6 percent and real GDP growth hovering near 5.5 percent. A downward revision of growth forecasts by the IMF or World Bank would confirm this scenario.

MEDIUM PROBABILITY: 40%

Incremental Reform with Mixed Implementation

Firms in major hubs see ROE rise by 3–4 percentage points and capex intentions up 15–18 percent, but second-tier provinces lag. If quarterly surveys report a 10–12 percent capex uptick in Hanoi and HCMC but under 5 percent elsewhere, the uneven rollout becomes evident.

Competitiveness metrics improve moderately: regulatory approval lead times shorten by 20 percent and ease-of-doing-business climbs 8–12 places, yet rural districts persist with legacy inspection routines. A national Doing Business update showing approval times averaging 20 days would mark the midpoint outcome.

Financial System benefits accrue mainly to mid-sized enterprises. SME loan approval rates climb to 60 percent (from 50 percent) but hover at 40 percent for micro-enterprises. Watch for banking sector data showing a moderate decline in SME loan-rejection rates without a surge in nonperforming exposures.

Technology & Innovation progress is visible in university–industry collaboration rising 12 percent year-on-year and patent grants up 8 percent, though talent shortages cap scale-up. If R&D joint projects grow but domestic high-tech exports remain flat, the innovation boost is partial.

Infrastructure & Urbanization sees flagship high-tech zones reach 65 percent occupancy and FDI net inflows edge up to 5.2 percent of GDP, while national averages stay lower. A government report flagging clusters that outperform versus those that underperform will highlight this mixed picture.

Macroeconomics & Growth tick higher, with private fixed-investment growth at 10–12 percent and GDP growth lifting to 6.5–7 percent. A mid-year upgrade of Vietnam’s 2026 growth forecast into this range would signal entry into this scenario.

HIGH PROBABILITY: 45%

Steady Momentum: Broad-Based Private Sector Expansion

Firms across regions capitalize on incentives, fueling a 5 percentage-point rise in median ROE, a 25 percent surge in capex intentions and a 15 percent uptick in private fixed-investment. If national corporate surveys record double-digit capex growth, the reforms are delivering.

Competitiveness accelerates as post-inspection oversight takes hold: regulatory approval lead times fall by 30 percent, ease-of-doing-business jumps 20 places and annual new business registrations surge by 25 percent. Look for enterprise-registry data confirming 300,000+ new firms.

- Financial System deepens: ESG-compliant lending climbs to 10 percent of total bank credit, SME loan rejection rates drop below 30 percent and manufacturing capacity utilization rises to 78 percent. Central bank statistics reflecting sustained credit flows at subsidized rates will validate this path.

Technology & Innovation flourishes with patent filings up 15 percent, venture-capital deal flow doubling within three years and tech start-up formation growing 30 percent. A VC industry report showing year-on-year deal flow above 50 percent would confirm a vibrant innovation ecosystem.

Infrastructure & Urbanization benefits are widespread: FDI net inflows reach 6 percent of GDP, green-field projects in high-tech parks double and national infrastructure-quality indexes improve sharply. Major green-field announcements in electronics and biotech will mark this advancement.

Macroeconomics & Growth accelerate sustainably: investment-to-GDP climbs above 35 percent, potential growth is revised up to 7.5–8 percent and real GDP growth sustains at or above 7 percent. Official revisions from the Ministry of Planning and Investment forecasting long-term growth above 7 percent will signal this outcome.

References for this Development

Doanh nghiệp tư có thể được hưởng loạt chính sách đặc biệt chưa có tiền lệ

Private businesses may enjoy a series of unprecedented special policies.

Dantri | Local Language | News

Nghị quyết cơ chế đặc biệt phát triển kinh tế tư nhân dự kiến thông qua vào cuối tuần này

Resolution on special mechanism for private economic development expected to be passed this weekend

Bao Dien Tu | Local Language | News

Chính phủ đề xuất nhiều cơ chế, chính sách đặc biệt phát triển kinh tế tư nhân

The Government proposes many special mechanisms and policies to develop the private economy.

VTV News | Local Language | News

Đề xuất loạt cơ chế đặc thù về đất đai, lãi suất cho doanh nghiệp tư nhân

Proposing a series of special mechanisms on land and interest rates for private enterprises

VN Express | Local Language | News

-

China and Mongolia Break Ground on New Cross-Border Railway to Boost Regional Trade

China and Mongolia are expanding their rail network and port capacities to strengthen cross-border trade and regional development.

On May 15, 2025, officials held a groundbreaking ceremony at the Ganqimaodu port in Inner Mongolia to begin construction of a second direct railway line between the two countries.

China Energy Investment Corp (CHN Energy), the nation’s largest coal-fired power generator, will build the Chinese segment. Scheduled for operation by 2027, this line marks the first new rail link since the Erenhot–Zamyn-Uud route opened in 1956.

The new railway will run from Ganqimaodu, tie into the existing Ganqimaodu–Wanshuiquan line, and extend to Mongolia’s Gashuunsukhait port.

That port is expanding its export and import gates from their current level to 22, effectively doubling its throughput capacity. The route also creates a direct corridor to Mongolia’s Tavan-Tolgoi coal deposit—one of the country’s largest reserves—already connected to Gashuunsukhait by a separate rail inaugurated in 2022.

Operators expect the line to handle about 30 million metric tons of cargo annually, and they project that Mongolia’s coal exports could climb to 165 million tons per year once all supporting infrastructure comes online.

In 2024, Mongolia shipped a record 84 million tons of coal—exceeding the government’s 83.3 million-ton target—even as export revenues declined despite high production. As of May 13, 2025, Ganqimaodu port reported coal imports of 12.71 million tons, a 9.18 percent year-on-year decrease.

Mongolian Prime Minister Luvsannamsrai Oyun-Erdene says the railway and port upgrades will add roughly $1.5 billion in export revenue each year and boost GDP per capita in both border regions by accelerating trade flows.

China and Mongolia anticipate that the improved corridor will move minerals and energy resources more quickly and in larger volumes.

Analysts at Xiamen University and other institutions view the project as a concerted effort to deepen bilateral trade relations and economic integration.

They predict the rail link will spur development of cross-border logistics, industrial parks, and border trade services, while strengthening infrastructure and economic activity in the sparsely populated frontier zones of Inner Mongolia and southern Mongolia.

References for this Development

中蒙第二条跨境铁路开建

Construction of the second cross-border railway between China and Mongolia begins

MOT | Local Language | Government

中蒙第二条跨境铁路开工建设

Construction of the second cross-border railway between China and Mongolia begins

Guangming Daily | Local Language | News

2nd railway to Mongolia commences construction

China Daily | English | News

China starts building 2nd cross-border railway to Mongolia in nearly 70 years

Peoples Daily | English | News

-

China Unleashes Reserve Requirement Cuts and Monetary Easing to Bolster Economic Growth in 2025

China’s central bank has launched a suite of monetary easing measures in 2025 to boost liquidity and stabilize economic growth.

On May 15, 2025, the People’s Bank of China cut the reserve requirement ratio by 0.5 percentage points for eligible financial institutions—the first such reduction this year. This action is set to inject about 1 trillion yuan (roughly 139 billion US dollars) of long-term liquidity into the market. It follows a May 7 package of policies that lowered interest rates and introduced new instruments aimed at steadying the economy amid domestic and international uncertainties.

The central bank also eliminated the deposit reserve ratio for auto finance and financial leasing companies by reducing it five percentage points to zero.

By freeing up these reserves, those firms can extend more credit toward automotive consumption and equipment investment, giving related industries and supply chains a fresh stimulus.

For the broader banking sector, the average deposit reserve ratio will fall from 6.6 percent to 6.2 percent.

Governor Pan Gongsheng told state media that this cut will improve liquidity provision, lower banks’ funding costs, and reinforce financial stability. With more reserves available, banks can expand lending to businesses and households, thereby driving down financing costs across the economy.

In tandem with reserve requirement cuts, the PBOC trimmed rates on several lending instruments, notably personal housing loans.

This rate reduction should lighten residents’ debt burdens, spur housing demand, and help steady the property market.

The central bank also adjusted its structural policy tools by raising re-lending quotas to channel additional support into agriculture, small and medium-sized enterprises, and technology innovation.

This proactive, counter-cyclical approach aims to promote economic transformation and sustained development in priority sectors.

Analysts expect the combined measures to boost long-term liquidity, enhance monetary policy transmission, and back investment, consumption, and anticipated funding needs from local government bond issuances.

Observers add that a larger liquidity buffer should shore up market confidence and steady economic expectations.

Looking ahead, the PBOC may pursue further easing through additional rate cuts and new financial instruments later in 2025.

It intends to balance quality and structural efficiency within its monetary policy framework to support long-term growth and maintain price stability.

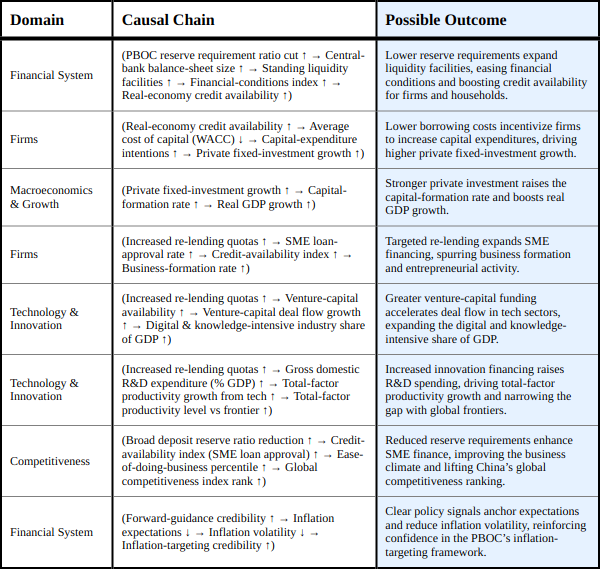

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The PBOC’s 0.5 percentage-point reserve requirement ratio cut (PBOC Reserve Requirement Ratio Cut) will inject roughly 1 trillion yuan of long-term liquidity into the banking system, expanding the central bank’s balance sheet, lowering interbank funding costs, and easing financial conditions—this should raise credit availability, reduce firms’ average cost of capital, spur private fixed-investment growth, and underpin a cyclical lift in real GDP growth.

Eliminating the deposit reserve ratio for auto finance and financial leasing companies (Elimination of Deposit Reserve Ratio for Auto Finance and Leasing) frees up sector-specific reserves and allows these firms to extend more credit for vehicle purchases and equipment investment—this stimulus is likely to boost output and sales in the automotive industry, strengthen related parts and service supply chains, and support downstream consumption.

Cutting the average deposit reserve ratio from 6.6 percent to 6.2 percent across the broader banking sector (Broad Deposit Reserve Ratio Reduction) will further lower banks’ funding costs and encourage expanded lending to households and SMEs—higher SME loan-approval rates should improve the ease-of-doing-business environment, raise the business-formation rate, and help elevate China’s ranking in global competitiveness indexes.

Reducing rates on personal housing loans (Personal Housing Loan Rate Cuts) will lighten debt servicing burdens for households, revive housing demand, and help stabilize property-market sentiment—this measure supports consumption, bolsters local-government revenue via property-related fees, and could prevent a sharper slowdown in real estate investment.

Raising re-lending quotas for agriculture, SMEs, and technology innovation (Increased Re-lending Quotas for Targeted Sectors) channels subsidized, low-cost credit into priority areas—this targeted liquidity boost is expected to lift SME loan-approval rates and business formation, increase venture-capital deal-flow, accelerate R&D expenditure, and drive total-factor productivity gains, thereby advancing China’s economic transformation and narrowing its productivity gap with global frontiers.

Enhanced forward guidance and signals of further easing (Core Driver: Policy Credibility and Communication) should anchor market and inflation expectations, reduce inflation volatility, and strengthen confidence in the PBOC’s inflation-targeting framework—this credibility effect allows for ongoing accommodative policy without fueling an uncontrollable rise in consumer prices.

References for this Development

China cuts reserve requirement ratio by 0.5 percentage points starting from May 15

China News | English | News

2025年首次全面降准正式落地,4月信贷利率保持历史低位

Beijing News | Local Language | News

释放流动性万亿元 2025年首次全面降准落地

Xinhua | Local Language | News

降准今起实施,将向市场提供长期流动性约1万亿元

Sina Finance | Local Language | News

年内首次降准落地!释放长期流动性约1万亿元

Xinhua | Local Language | News

China's first RRR cut for financial institutions in 2025 takes effect

Xinhua | English | News

新华社消息|年内首次降准落地!释放长期流动性约1万亿元

Xinhua | Local Language | News

-

Hyundai and Saudi Arabia Launch Construction of Kingdom’s First Automotive Production Plant

Saudi Arabia has commenced construction of its first domestic automotive production plant through a partnership between Hyundai Motor Company and the Public Investment Fund.

On May 14, 2025, officials gathered at the King Salman Automotive Cluster in King Abdullah Economic City to break ground on the Hyundai Motor Saudi Manufacturing Company (HMMME) plant. More than 200 dignitaries attended, including Industry Minister Bandar Alkhorayef, Hyundai Motor Group Vice Chairman Chang Jae-hoon, and PIF representative Yazeed Alhumied.

HMMME draws on a joint-venture structure in which Hyundai Motor Company holds a 30 percent stake and the PIF holds 70 percent.

The facility will build electric vehicles alongside internal combustion engine models, targeting an annual capacity of 50,000 units and a planned launch of operations in the fourth quarter of 2026. As Saudi Arabia’s first automotive production site, the plant supports Vision 2030 by diversifying the economy beyond oil and by positioning the King Salman Automotive Cluster as a focal point for national mobility development and advanced manufacturing.

Hyundai views the project as a key element of its global expansion, integrating its manufacturing technology with local talent and infrastructure.

Chang Jae-hoon emphasized how the plant will fuse Hyundai’s engineering expertise with Saudi Arabia’s workforce. Yazeed Alhumied stressed the joint venture’s role in building domestic capabilities and generating skilled employment in the automotive sector.

To advance broader mobility initiatives, Hyundai is partnering with the Korea Automotive Technology Institute and the Saudi Public Transport Company to establish a hydrogen mobility ecosystem.

Planned programs include hydrogen-electric buses and collaborative research aimed at maturing hydrogen energy technologies in the Kingdom.

By generating thousands of jobs, facilitating the transfer of industry knowledge and technical skills, and accelerating the growth of Saudi Arabia’s automotive and mobility ecosystem, the HMMME plant will play a pivotal role in the country’s industrial transformation.

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The groundbreaking of Saudi Arabia’s first domestic automotive plant in King Abdullah Economic City constitutes a historical shock that redirects the Kingdom’s development trajectory from oil dependency toward advanced manufacturing. This event triggers large-scale infrastructure upgrades—roads, ports and logistics hubs—that raise the infrastructure-quality index, improve the Logistics Performance Index, shorten export lead times, and boost Saudi Arabia’s real export market share in automotive components and finished vehicles.

The formation of the Hyundai Motor Saudi Manufacturing Company joint venture, with a 70 percent PIF stake and a 30 percent Hyundai stake, represents a major foreign-domestic investment shock. This JV elevates Saudi trade-openness and preferential access, drives FDI inflows as a share of GDP, lifts business-confidence diffusion, and spurs a higher overall investment rate; it also deepens the financial system, enhances SME credit availability, lowers the average cost of capital, and fuels private fixed-investment growth in related industries.

The rapid 18-month ramp-up to a 50,000-vehicle annual capacity imposes a tight production‐build shock that compels regulatory fast-tracking and process reforms. As regulatory-approval lead times fall, capacity-utilisation in manufacturing rises sharply, accelerating non-farm labour productivity growth and necessitating expanded vocational training and STEM education to address emerging skill shortages.

References for this Development

사우디 공장 착공…중동 전초기지 세운다[현대차, 중동을 품다①]

Newsis | Local Language | News

Hyundai Motor breaks ground on 1st Middle East plant in Saudi Arabia

Yonhap | English | News

현대차 첫 중동 생산거점 '사우디 공장' 착공…年 5만대 내년 4분기 가동

ET News | Local Language | News

(LEAD) Hyundai Motor breaks ground on 1st Middle East plant in Saudi Arabia

Yonhap | English | News

Hyundai breaks ground on Saudi factory, its first auto plant in Middle East

Joongang Ilbo | English | News

Business Asia covers business, economics, and operations-related issues for South Korea, Japan, China, Taiwan, India, and Vietnam.

We monitor news media, social media, government releases at the national and state/city levels, foreign embassies, business associations, podcasts, videos, and more, from 12 countries in Asia and around the world, to bring you the best, most current analysis available for both risk management and operations decision-making.

Security Asia

Want a report like this that focuses on security developments in Asia? You're in luck. Subscribe to Security Asia at securityasia.substack.com.

Cognitive Asia

Want a report a like this that focuses on developments in AI, Semiconductors, and Cloud Computing Asia? There's a Substack for that. Subscribe to Cognitive Asia at cognitiveasia.substack.com.

This report is provided as an informational resource for subscribers and represents our diligent and good faith efforts to compile and analyze the best information available to us at the time of writing. The content herein is derived from various sources, including, but not limited to, news articles, government publications, and data releases. We make no representations or warranties, express or implied, as to the accuracy, reliability, or completeness of the information provided in this report. It is important to note that we have not independently verified the assertions and information obtained from these third-party sources.

The information contained in this report is provided "as is" without warranty of any kind. The use of this report and the information within it is at the sole risk of the subscriber/reader. We expressly disclaim all warranties, whether express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, and non-infringement. We do not warrant that the information in this report will meet your requirements or that the operation of the information will be uninterrupted or error-free.

While every effort has been made to ensure the accuracy and completeness of the information contained within this report, we cannot guarantee that it is free from errors or omissions. We are not responsible for any actions taken or not taken based on the information provided in this report. Subscribers and readers should conduct their own due diligence as necessary before taking any action based on the information herein.